Stability on the Surface, Pressure Beneath: The Distressed Market Year-End Review

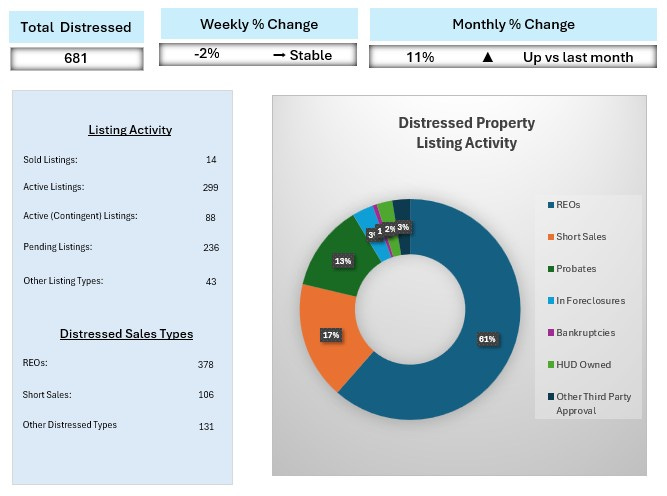

Weekly inventory dips slightly (-2%), but monthly data reveals an 11% rise in distressed supply—signaling structural shifts for 2026.

This analysis reviews distressed market activity for the week of December 22, 2025, to December 28, 2025.

To understand the real estate market fully, we must distinguish between two primary segments. The first is the traditional “turnkey” market—homes that are move-in ready, marketed broadly, and generally set the pricing standard for neighborhoods.

The second is the distressed housing market. This segment includes properties facing physical deterioration, financial default, or ownership disputes (such as probate or divorce). While the turnkey market tells us what a home is worth at its best, the distressed market reveals something equally important: where affordability pressures are mounting, where pricing floors are being tested, and where access points are emerging for those willing to do the work.

This segment matters because it is often the primary vehicle for accessible wealth creation. For working-class households and small investors, distressed inventory—when approached with discipline—can provide a path to homeownership and equity that the turnkey market no longer offers.

Whether you are evaluating a potential purchase, managing an investment portfolio, or navigating financial pressure as a homeowner, the data below is intended to replace speculation with clarity. This article is for educational purposes, helping you understand how professional valuation consultants interpret market signals so you can make decisions aligned with reality.

The Philadelphia metropolitan distressed market closed 2025 with a mixed signal: short-term stabilization masked by long-term accumulation. For the week ending December 28, total distressed listings dropped slightly by 2% (from 693 to 681). This decline is consistent with typical seasonal behavior during a holiday week.

However, the broader monthly trend tells a more significant story. Distressed inventory for December (769 total listings) represents an 11% increase over November. This indicates that while transaction activity slowed for the holidays, the pipeline of distressed assets continues to expand. The market is not “clearing” inventory as fast as it is accumulating it.

Key Segment Analysis

Bank-Owned Dominance (REOs): The market is heavily weighted toward Real Estate Owned (REO) properties, which account for 378 listings (approximately 56% of distressed inventory). This suggests that lenders are actively clearing foreclosure backlogs. Conversely, Short Sales remain lower at 106 listings, indicating that fewer homeowners are successfully negotiating pre-foreclosure exits compared to the volume of homes being repossessed.

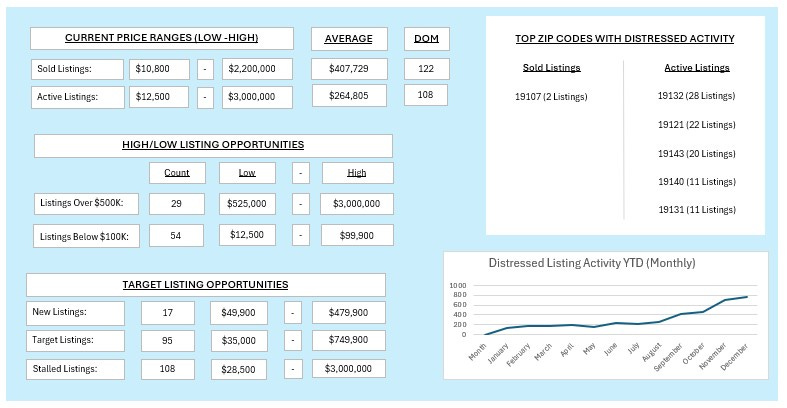

Price Bifurcation: The market is sharply divided. On the lower end, there are 54 listings priced below $100,000, concentrated in high-distress zip codes. These represent the primary target for value-add buyers. On the opposite end, there are 29 listings priced over $500,000, which often include estate sales or commercial assets that face smaller buyer pools and longer marketing times.

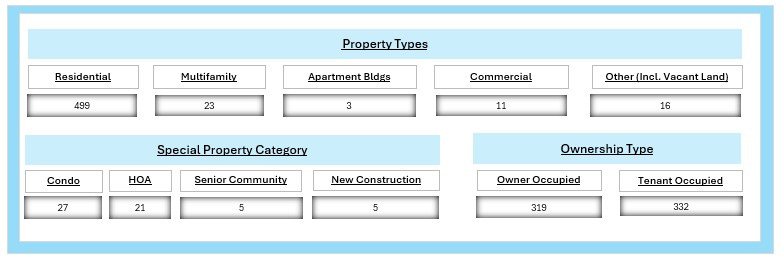

Occupancy Trends: A notable data point this week is that tenant-occupied distressed listings (332) slightly outnumber owner-occupied listings (319). This signals ongoing pressure on the small landlord segment, where rental income may no longer cover debt service or deferred maintenance costs.

We are in a state of structural expansion. While the weekly data shows a pause, the trajectory heading into 2026 is one of rising supply. The gap between Active listings (299) and Sold listings (14) for this specific week highlights a market where supply is readily available, but absorption is selective. Buyers are not snapping up everything; they are picking through the inventory, leaving overpriced or “stalled” listings to sit for an average of over 100 days.

Buying Equity Premium Newsletter

If you find this analysis helpful, consider subscribing to the Buying Equity Premium Newsletter. In addition to these public market breakdowns, Premium subscribers receive exclusive educational content on valuation techniques, deep dives into specific asset classes, and extended Q&A sessions on how to apply these insights to real-world scenarios.

The same market data means different things to different participants. Below is a breakdown of how this week’s metrics impact specific groups.

Residential Value Buyers

Buyers looking to purchase a home to live in, using sweat equity to bridge the affordability gap.

Broad Goals: Secure homeownership at a price point below the turnkey market and build equity through renovation.

Relevant Market Signals: The report identifies 54 active listings under $100,000. Furthermore, the average Days on Market (DOM) for active listings is 108 days, with many “stalled” listings sitting even longer.

Practical Strategy (Risk & Opportunity):

Opportunity: The high DOM suggests that sellers (especially banks with REOs) may be experiencing “listing fatigue.” Use this to your advantage by negotiating aggressively on properties that have been sitting for 3+ months.

Risk: Low-priced inventory often requires cash or specialized renovation financing (like FHA 203k). Ensure your financing is lined up before making offers, as banks favor “sure thing” closings over high prices.

Short-Term Investors (Renovate & Resell)

Investors looking to acquire, renovate, and sell for a profit (flippers).

Broad Goals: Acquire assets with sufficient spread between purchase price and After Repair Value (ARV) to cover costs and profit.

Relevant Market Signals: Geographic concentration is key. Zip codes like 19143, 19132, 19121, and 19140 are showing the highest volume of distressed inventory. However, the modest sales volume (14 sold vs. 236 pending) suggests that while deals are going under contract, the closing process is lengthy.

Practical Strategy (Risk & Opportunity):

Opportunity: Focus acquisition efforts in the high-volume zip codes where comparable sales are easier to justify. The abundance of REOs (378 units) provides a steady stream of consistent inventory.

Risk: Exit values may soften if inventory continues to rise. Stress-test your deal margins: if the market value drops 5% during your renovation, is the project still profitable?

Long-Term Investors (Buy & Hold)

Investors building rental portfolios for cash flow and long-term appreciation.

Broad Goals: Acquire stable assets where rental income exceeds expenses.

Relevant Market Signals: The data shows 332 tenant-occupied distressed listings. This is a critical signal. It implies that many available properties already have residents, which presents both a management challenge and a stability opportunity.

Practical Strategy (Risk & Opportunity):

Opportunity: Purchasing tenant-occupied distress often scares away owner-occupants and flippers, reducing competition. If the numbers work, these can provide immediate cash flow.

Risk: Inheriting tenants in a distressed situation often means inheriting payment issues or deferred maintenance complaints. thorough due diligence on leases and tenant ledgers is mandatory.

Owners of Distressed Properties (Considering Selling)

Homeowners with physical or financial distress who have equity and can sell voluntarily.

Broad Goals: Maximize net proceeds and sell before conditions worsen.

Relevant Market Signals: Inventory is rising (up 11% month-over-month). You are competing directly against 378 Bank-Owned (REO) properties. Banks are generally unemotional price-cutters.

Practical Strategy (Risk & Opportunity):

Opportunity: There are still 236 properties in “Pending” status, meaning buyers are active. If you price correctly, you can sell.

Risk: Overpricing in a rising-inventory market is dangerous. If you price too high, your home will become one of the “stalled” listings, eventually forcing you to sell for less than you could have gotten today.

Owners Facing Foreclosure or Short Sale

Homeowners with little to no equity facing imminent lender action.

Broad Goals: Avoid foreclosure, minimize credit damage, and transition with dignity.

Relevant Market Signals: The ratio of REOs (378) to Short Sales (106) is stark. It indicates that for every homeowner who successfully negotiates a short sale, nearly four homes are being taken back by the bank.

Practical Strategy (Risk & Opportunity):

Opportunity: The window to negotiate a short sale exists, but it requires immediate action. The market has buyers, but they need time to close.

Risk: Delaying communication with your lender significantly increases the probability of becoming an REO statistic. The rising foreclosure volume means lenders are processing defaults faster.

What This Market Trend Could Means for You

The current data depicts a market that is normalizing after years of anomaly. For buyers, the “access” constraint is shifting from a lack of inventory to a requirement for capital and courage. The inventory is there—particularly in the sub-$200k range—but it requires vision and renovation capability.

For the market as a whole, the risk profile is changing. In a scarcity market (low inventory), a bad purchase is often forgiven by rising prices. In an accumulating market (rising inventory), overpaying for a distressed asset is a mistake that time may not fix quickly.

The defining characteristic of this week’s data is selectivity. Buyers have choices. They are ignoring the overpriced and the structurally unsound, and competing for the well-priced and the viable. For anyone entering this space—whether buying or selling—success will depend on aligning your expectations with this data-driven reality.

The distressed market is complex, but it is not impenetrable. By stripping away the emotion and focusing on the data—inventory levels, days on market, and occupancy trends—we can see the path forward more clearly.

Whether you are looking to secure a home for your family, build a portfolio, or resolve a difficult financial situation, the first step is understanding the playing field.

Visit My Website: RWilliamsPropertyAdvisor.com

Disclaimer: This article is for informational and educational purposes only. It does not constitute financial, legal, or real estate advice. Real estate markets are local and variable; always consult with qualified professionals regarding your specific situation.